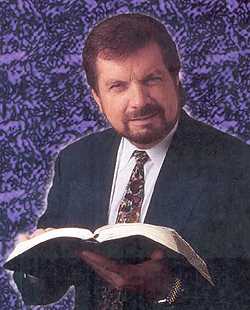

BLURRING THE LINE

Denton televangelist Mike Murdock makes few

distinctions between his resources and those of the ministry he founded.

Some critics question whether his actions are proper.

Denton televangelist Mike Murdock makes few

distinctions between his resources and those of the ministry he founded.

Some critics question whether his actions are proper.

By Darren Barbee

Star-Telegram Staff Writer

Not too long ago, Denton televangelist Mike Murdock got an idea, he said during a television broadcast in November.

What was it? He didn't say. He said only that it made him thousands of dollars. In 2002, with the money from that idea, he said, he bought a 1973 Cessna Citation 500, a small corporate jet that usually seats six.

"God gave me an idea that bought me a jet [with] cash," he said.

But Murdock does not own the jet. The Mike Murdock Evangelistic Association bought it in August, according to the Federal Aviation Administration. Murdock uses the jet, probably worth $300,000 to $500,000, to travel to appearances at conferences and telethons. He says the corporate jet allows him to do more work than he could on a commercial aircraft.

Did Murdock buy the jet, then donate or sell it to the ministry? He doesn't say.

Whatever the case, Murdock makes few distinctions – privately or publicly – between ministry resources and his own, a Star-Telegram review found. There are numerous examples:

- Over the years, the ministry has solicited personal gifts for Murdock even as he has told donors – on tapes and during broadcasts – that the ministry sorely needed money.

- Ministry staff members oversee his Denton County estate and handle personal tasks for him.

- The ministry uses donor money to support Murdock's father and his son.

- Murdock has apparently overseen transactions between the ministry and for-profit companies he owns.

The ministry's accountants say that Murdock has done nothing illegal and that the association was reimbursed to the letter of the law for the time ministry staff members spent working for Murdock or at his estate. Former employees say Murdock is strict about keeping his expenses separate from the ministry's. Yet they also say there is no separating Mike Murdock the man from Mike Murdock the minister.

Experts questioned whether the ministry has skirted a federal law that says nonprofit organizations' activities must be directed exclusively toward promoting a charitable, religious, educational or other type of service exempt from taxation.

"Such an organization's activities may not serve the private interests of any individual or organization," according to the Internal Revenue Service's Tax Guide for Churches and Religious Organizations.

In particular, some lawyers questioned the ministry's solicitation of gifts for Murdock.

Robert Wexlar, a San Francisco lawyer, said the practice seems unusual.

"Certainly, raising money with language suggesting it's a gift for a particular individual is not appropriate," he said.

But the lawyers say the legal codes governing nonprofit groups are so vague that financial records can be manipulated to bend the law without breaking it. Most nonprofits strive to go beyond what is legal to focus on what is proper, said Thomas Wolf of Wolf, Keens & Co., a consulting firm in Cambridge, Mass., that specializes in nonprofit corporations.

"Because we deal with donors who really have very high standards, we're as concerned about the appearance of conflict of interest or appearance of inappropriate use of funds, even if we can justify them," he said.

Murdock dismisses any effort to scrutinize the ministry's practices as an attack by evil powers meant to distract him from his mission of spreading the Word of God.

He quotes Billy Graham, saying: "My enemies would not believe my explanation. My friends do not require an explanation."

Asking for gifts

For several years, the ministry has asked people to give presents to Murdock. And he has said he welcomes such gifts.

In October, Murdock's sister Deborah Murdock Johnson wrote to those on the ministry's mailing list asking for a "love offering" for her brother in honor of clergy appreciation day. An enclosed envelope read "Personal to MM only."

In September 2001, Johnson also wrote to those on the ministry's mailing list, requesting personal donations for her brother.

"Dr. Murdock is having some work done at his home. ... $500, $100 or any amount would mean so much to him," wrote Johnson, who works for the ministry.

In October 1998, Frank Berry made a similar pitch, telling donors to use a special envelope "to assure that your gift is given to Dr. Mike personally." The letter identifies Berry as a ministry board member, though he is not listed that way on IRS filings.

In April 1997, the ministry's general manager wrote donors to tell them that Murdock's birthday was coming up.

"He always focuses on his ministry but we are asking and believing for 300 of his closest friends to sow an extra Seed of LOVE to him personally," the letter said.

That same year, on the ministry's TV program, Wisdom Keys, Murdock said he wanted as many of his viewers as possible to attend his 51st birthday celebration at the ministry's headquarters.

"You don't have to bring a present, but I sure will enjoy one if you bring it."

In 1996, for Murdock's 50th birthday, the ministry received enough cash gifts to buy him a used $12,000 Chevrolet Corvette, according to ministry documents.

The ministry's solicitation of presents for Murdock is questionable, said several experts knowledgeable about nonprofit organizations.

Such solicitations could be legal if the gift went to the ministry rather than Murdock personally; if he had a contract tying his salary to what his name brought in; or if the gift-givers did not claim a tax deduction, said one expert who advises several nonprofit organizations.

"If they're simply turning money over to him, I think the IRS would have a real problem with that," said the expert, who spoke on the condition that he not be named.

Dan Busby, vice president of donor services for the Evangelical Council for Financial Accountability, said that he did not think such solicitations are illegal but that they are highly unusual for nonprofit organizations, though not churches.

Busby said any money Murdock collected through the offerings would be considered taxable income.

Accountant John Walker of Chitwood & Chitwood of Chattanooga, Tenn., the ministry's new accounting firm, said that he hadn't reviewed the appeals but that in general, such solicitations are perfectly legal. Whether the gifts are termed "love offerings," "blessings" or "birthday gifts," they are simply income, he said.

But Ole Anthony of the Trinity Foundation, a televangelist watchdog group in Dallas, finds the solicitations offensive.

"He's always for years and years used his birthday as a tool for subtly hinting that he should be given birthday presents," Anthony said. "There's something so sleazy about that it makes one sick to their stomach."

One donor who gave Murdock a birthday gift in 1998 was surprised to learn that his compensation package from the ministry that year totaled more than $337,000.

Beverly Franton of West Monroe, La., sent Murdock a birthday present, a check for $25. Shortly afterward, she received a note from his secretary informing her that he needed new shirts.

"I sent $25, which is a drop in the bucket, apparently," Franton said recently. "It was his birthday money, to do whatever he wanted to with."

Sharing employees

Murdock's Denton County estate, known as Hacienda de Paz, was so integral to the ministry that the position "Hacienda supervisor" was just below "general manager" on organizational charts in the late 1990s.

Whether that refers to management of Murdock's estate or of a home office used for ministry business is unclear.

But Murdock has used ministry staff members to oversee his estate.

At least two ministry employees worked primarily at Murdock's home. Others went there to make Murdock fresh carrot juice, set his table and run his errands, ministry documents show.

- In summer 1998, then-general manager Matti Cook-Smith tended his exotic pets, coordinated the cleaning of his garage, and selected carpets and tile for the Hacienda, according to ministry documents obtained by the Trinity Foundation. Cook-Smith declined to be interviewed.

- On Sept. 24, 1998, Murdock wrote to his handyman, who was listed on the ministry's payroll forms, saying, "Would like for you to help me clean out the garage completely ... so that I can park the Jaguar next to the Corvette."

- In an April 30, 1998, memo, Murdock is advised that three employees could attend a valet school to learn "basic hospitality and etiquette."

- Cook-Smith carried Murdock's checkbook and had access to his credit cards, according to ministry documents and former employees.

Walker said in a November interview that he had seen canceled checks showing that Murdock reimbursed the ministry whenever its employees spent more than 20 percent of their time at his estate. He did not make those checks available to the Star-Telegram.

"All of the work they did at Dr. Murdock's home was reimbursed by him personally to the ministry," Walker said. "We made sure of that before we took the account."

Only two ministry employees worked exclusively at the Hacienda, where they served as jacks-of-all-trades, he said. Murdock reimbursed the ministry for all their hours but did not have to reimburse it for benefits because the two didn't receive any, Walker said.

But in telephone conversations last month, Walker said the two men did not work exclusively at the Hacienda. He also said that Murdock had reimbursed the ministry for the two men's benefits, including health insurance and Social Security. Indeed, Murdock paid more than what was required, Walker said.

A point of contention is how often other ministry employees worked at Murdock's home.

Faye Snyder, who was Murdock's administrative assistant in 1998, said several employees worked at his home, including her husband, David. She said he worked there almost exclusively.

"He didn't actually work just occasionally," she said. "That was his designated place."

In November, Walker said David Snyder only fed Murdock's dogs.

"We didn't [reimburse] for that," he said. "He's only out there about 30 minutes per day. There's no reimbursement required ... by law."

Walker said Murdock's personal use of such employees was legal because an individual would have to benefit substantially to violate IRS law.

"We deem that to be 80 percent of the time," Walker said.

But last month, Walker said Murdock had reimbursed the ministry for all such expenses.

The reimbursement issue aside, lawyers and accountants noted that Murdock's practices do not appear to advance the ministry's goal of spreading the Gospel.

Ministry employee Laura Coulter said Murdock needs the help because he spends hundreds of hours traveling.

"Dr. Murdock is no different from a CEO with a maid and a butler and a housekeeper and a nanny," Coulter said.

She said that Murdock is doing God's work and that she wouldn't have stuck with him for 31 years if she didn't trust him.

"I work for the ministry. But the ministry is Dr. Murdock. They are one in the same," Coulter said. "If you don't have passion for a person, if you don't believe in the person, you have no business being there."

Books and songs

On Wisdom Keys, Murdock has attributed his prosperity to several sources, including thousands of dollars in royalties from books and songs and windfalls from business deals inspired by God.

He is vague about the details. But records show that he has three for-profit companies: Wisdom International, Win-Song Productions and Win-Com Media. The companies hold copyrights to his books and songs, he says.

Documents show that those companies share the ministry's address. Their boards include ministry officials. They have done business with the ministry. Murdock also promotes his books and songs through the ministry and on Wisdom Keys. What's more, the ministry sells the books and music cassettes on its Web site and at seminars.

There is conflicting information about whether Murdock's company makes money from the arrangement. IRS forms the ministry filed from 1993 to 2000 indicate that money changes hands.

"Bibles, books, and tapes are manufactured and produced by Wisdom Int'l, Mike Murdock Evangelistic Assn purchased them for the ministry at their normal wholesale value," the ministry told the IRS on forms that Murdock appears to have signed.

The ministry also said on the forms that it had loaned money or extended credit to Murdock's three companies and had furnished employees and office space to them at fair market value. Such disclosures are required to prevent conflicts of interest.

Ministry employees said they helped Murdock complete books. But several former and current employees said they were not aware of Wisdom International and did not know whether they had worked for the company.

In contradiction to the IRS forms, Murdock says no money changes hands.

"We're giving away over a million books a year in the body of Christ," Murdock said during his October "School of Wisdom" seminar in Grapevine.

"Somebody said the other day, 'Now, does the ministry pay you for all those books you give away?' I said, 'They should.' No, no, I do not receive any feedback money from my ministry," he said.

Walker suggested that Wisdom International might have been included on the IRS documents for bookkeeping purposes, but he had not looked at the records in detail when he was interviewed in November.

In February, Walker said Chitwood & Chitwood was looking into the issues of publishing rights and royalties.

Murdock has said that he collects royalties on some of his books.

During a broadcast in December, he said he gets income from royalties associated with a series of "topical bibles" he created. The ministry has sold those books, but it is not clear whether the ministry has also given them away. The books have been sold at retail outlets as well.

In 1997, Murdock used ministry airtime to urge viewers to buy The Leadership Secrets of Jesus, which was published through an independent company.

"It will be a great blessing to you," he said.

He told viewers they could buy it at bookstores such as Waldenbooks and Wal-Mart. If the book made money, it is not clear who received the profits.

Murdock has also received royalties for songs, both as composer and as publisher, he wrote in 58 Covenant Blessings. But he said on a recent audiocassette that he receives no money from the ministry for his songs.

Wisdom International did not print the Murdock books distributed by the ministry, according to documents obtained by the Trinity Foundation. From 1997 to 1999, the ministry paid Able Press, a now-defunct Alabama company owned by Berry, to do much of the printing.

Berry said he could not recall how the ministry and Wisdom International functioned together. But he said he had submitted bids to the ministry for every printing project Able Press handled.

Walker said the books were bought at cost from Able Press. But when he was interviewed in November, he was not clear on the exact relationship among the ministry, Wisdom International and Able Press.

| The Internal Revenue Service grants tax-exempt status to

organizations whose activities further charitable, educational,

religious or other exempt purposes. The organizations' activities

must be directed exclusively toward those goals. The activities may

not serve the private interests of any individual. Nor can they give

a financial advantage to the organization's insiders – a practice

known as inurement. Practices such as paying unreasonable

compensation or transferring property to insiders for less than its

fair market value violate the law. Any amount of inurement, even $1,

is grounds for losing tax-exempt status, the IRS says.

-SOURCE: IRS Publication 1828, Tax Guide for Churches and Religious Organizations |

Dallas tax accountant Ken Sibley, who reviewed the ministry's IRS forms at the Star-Telegram's request, said that the transactions appear legal but that they are unusual. He said the amount of money the ministry spent to print the books – rarely topping $550,000 – seemed too little to be concerned about.

"While it would certainly be something I would advise against, with the related-party relationship there, I don't know that there's anything wrong with what they did," Sibley said. "We try to maintain a level such that even the appearance of impropriety is something that we want to avoid."

Other evangelical associations take pains to disclose transactions between nonprofit and for-profit corporations.

The Billy Graham Evangelistic Association has been willing to answer detailed questions about its related for-profit venture, World Wide Publications.

World Wide Publications funnels all profits into Graham's ministry, according to its IRS forms.

If there were profits from Wisdom International, they were not put back into the Murdock ministry, according to IRS forms.

Murdock may use ministry offerings to make a record or make a book, but that is an investment in the ministry, said his brother John.

People will never know how much of his own time and money Murdock has devoted to the ministry, his brother said. "He has constantly put stuff back, put stuff back in, put stuff back in."

About this project

Star-Telegram religion writer Darren Barbee spent six months examining the Mike Murdock Evangelistic Association. Staff writers Jeff Claassen and Mike Lee and librarian Jan Fennell provided research assistance. The Trinity Foundation provided some documentation. The project editor was Lois Norder. The articles were copy-edited by Scott Mitchell and John Lydon. The photographers were Ian McVea, M.L. Gray and Rick Moon, and the photo editor was Mark Rogers. W. Matt Pinkney created the illustration. Sarah Huffstetler designed the pages. Tim Bedison produced the graphics.

You may comment on this project by calling Darren Barbee at (817) 685-3818 or Lois Norder at (817) 685-3823.

On the Web

GuideStar

http://www.guidestar.org/

Evangelical Council for Financial Accountability

http://www.ecfa.org/

Mike Murdock Evangelistic Association

http://www.mikemurdock.com/

Billy Graham Evangelistic Association

http://www.billygraham.org/

Trinity Foundation

http://www.trinityfi.org/

Ministry gives money to Murdock's relatives

By Darren BarbeeStar-Telegram Staff Writer

3/03/2003

The brass-colored door knocker on the small house in Argyle is engraved with the words The Murdocks.

The Rev. J.E. Murdock, wearing a blue jumpsuit, answers the door of the home he believes his son, Denton televangelist Mike Murdock, bought for him.

The house is tax-exempt and belongs to the nonprofit Mike Murdock Evangelistic Association, Denton County records show.

J.E. Murdock is a lean, broad-shouldered man with a firm handshake. And even if some memories have faded from the 86-year-old's mind, Scripture saturates his language, and his voice rises and falls as if he were still in the pulpit.

When asked whether his son bought the house, J.E. Murdock said he believes that is so.

"And [he] furnished everything," he said.

Some of the ministry's chief beneficiaries are Mike Murdock's relatives, documents show. The ministry, incorporated in 1973 to spread the Gospel and provide charity, gives money to or employs Mike Murdock's father, sister, son and niece.

Since the Star-Telegram began examining the association's finances, Murdock has offered a few more details about how ministry money benefits people close to him.

After years of using donations to provide his father with not only a home but also a car and a salary, Murdock acknowledged the arrangement in a letter in November to those on the ministry's mailing list.

IRS forms haven't shown the extent of the ministry's support for Murdock's relatives. The 2001 form is not yet available.

Murdock's son, Jason, gets $1,400 each month, Murdock said Oct. 19 in Grapevine.

"I want my family blessed. I want my children blessed. I want my son, Jason, blessed," Murdock said. "In fact, our ministry underwrites him about $1,400 a month while he works in a safe house in Atlanta, just to help him out. He's working night and day in a street ministry there."

Murdock said his sister Deborah Murdock Johnson works for him. The ministry's accounting firm said she handles publishing for the association.

One of his nieces works for the ministry, Murdock said last year.

The house where J.E. Murdock lives – valued at $104,095 – was Mike Murdock's parsonage when the ministry had a church in Argyle, according to the Denton Central Appraisal District. A 1997 Lincoln Continental owned by the ministry is routinely parked in the garage for J.E. Murdock to use.

Each month, J.E. Murdock receives a salary for preaching, Mike Murdock wrote in the November newsletter. He didn't disclose the amount.

The ministry reported on one of its IRS forms that J.E. Murdock received no compensation for serving as a board member, though it listed him elsewhere on the form as having received an allocation.

According to the instructions, the IRS documents must "show all forms of cash and noncash compensation received by each listed officer, etc., whether paid currently or deferred."

Filing an incomplete form can lead to penalties for the nonprofit corporation and the individuals responsible.

J.E. Murdock said he has lived in the house for several years. None of the tax documents from 1997 to 2000 indicate that he was allowed to live in the home.

An attachment to ministry tax forms shows that J.E. Murdock received an allocation during those years. In 2000, the ministry gave him $13,250. It is not clear what the money was for. But some of the others who were listed on the attachment said that they had been paid for preaching or singing or that they had received gifts.

In the ministry's newsletter, Murdock wrote that his father's accommodations and salary were "a very small reward for 63 years of ministry."

In October in Grapevine, Murdock said his father never earned more than $125 a week when he worked as a pastor.

It's up to the board to decide whether a ministry should provide salaries and living arrangements for trustees, said Chris Hempe, an accountant and the president of MinistryWatch, which monitors Christian nonprofit organizations.

"The bigger-picture issue is if you're going to compensate a board member for something they're doing ... there's a rule there against providing what they call excess benefit," he said.

"If it can be proven that the nonprofit gave somebody basically some sort of compensation ... that exceeded the value of what it was really worth, that's excess benefit."